Jessica Alba’s “Startup Unicorn”

Not surprisingly, many celebrities are becoming entrepreneurs. They have capital and a charged audience already at the start. However, a well-known name is unable to save a business from failure, and personal recognition is not at all behind the success. A well-thought-out business plan and marketing strategy is what really matters to any organization, and celebrity companies are no exception.

Here are 6 business cases from world celebrities that you can learn from.

Hollywood fame allowed actress Jessica Alba to speak about the issue of sustainability to a huge audience, turning followers into customers. But this did not insure her company against a serious crisis.

Alba came up with the idea to found her own brand of natural baby products back in 2008. The pregnant actress tried to find eco-friendly products without synthetic ingredients at a reasonable price, but there were almost no such products on the market. Alba, who has suffered from allergies and asthma since childhood, said: “I felt that my needs as a modern person were not being met. I wanted a beautiful design, but such a product should not be overpriced and, of course, it should be safe. ”

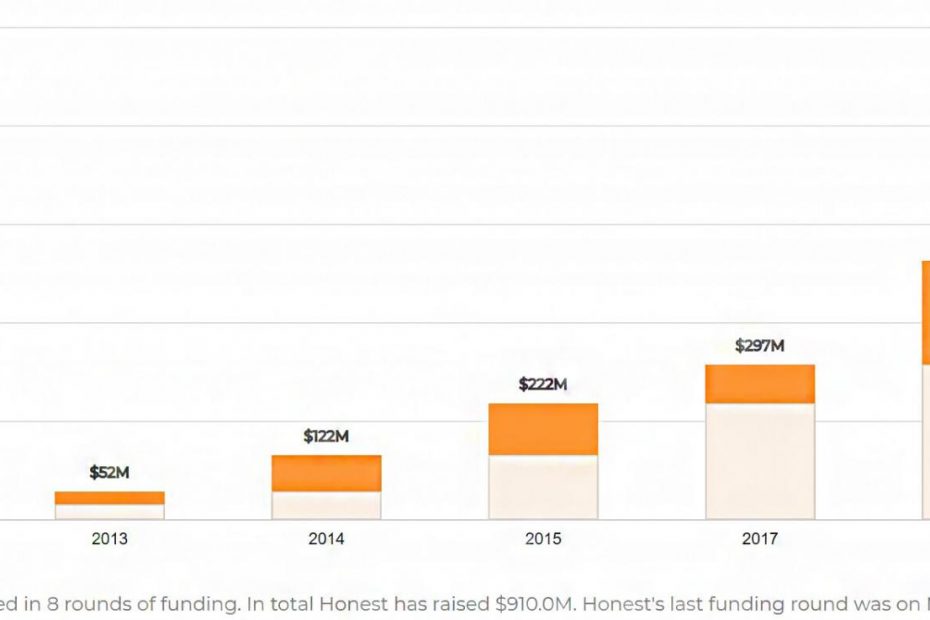

The Honest Company was launched in 2011. Its initial capital was $ 6 million. The startup’s first merchandise was diapers and baby care products. But as investments increased, so did the lineup: in 2014, the company launched other product categories – cleaning detergents, multivitamins and even children’s furniture.

The Honest Company has focused on online commerce. But soon, luxury baby stores in Los Angeles and New York offered to distribute the company’s products in-house. The Honest Company sold so well that they were approached by major chains like Cosco, Target and Whole Foods.

When Alba appeared on the cover of Forbes in June 2015, the publication estimated the business at $ 1 billion, and the actress’s share, which was supposedly 15-20%, at $ 200 million. In 2 months, The Honest Company managed to get another $ 100 million investments, which ensured Alba getting into the list of the richest self-made women in America according to Forbes. Now her fortune was estimated at $ 340 million.

Source: Forbes

The companies predicted a bright future, it was expected to go public. However, lawsuits rained down on The Honest Company. The brand has been accused of containing synthetic ingredients, and the company’s advertising is misleading. Several consumers have reported sunburn after using the branded sunscreen.

Litigation has damaged the brand’s reputation. Growth slowed and plans to go public were paused. Unilever, which had intended to buy The Honest Company, ditched the idea. In 2017, Alba’s company had to recall baby wipes – due to mildew in several packages – and powder due to concerns that it could cause eye infections. The unicorn status has been lost.

To get the company out of the crisis, it had to cut staff, stop producing some of the goods, revise the recipe for 90% of the products and abandon the direct delivery model to customers.

New CEO Nick Vlachos, with 25 years of experience in the consumer products industry, suggested focusing on the bestselling baby and beauty products that fueled the company’s early growth. And in order to regain customer confidence, The Honest Company decided to control the quality of goods in its own laboratories.

The marketing focus was on social media, where Alba has a huge audience. During the COVID-19 pandemic, new opportunities opened up for the company – it reoriented to disinfectants.

In 2020, revenue increased by 28% and amounted to $ 300.5 million, as in 2016. This was the main argument for investors when The Honest Company went public in May 2021 at $ 16 per share. According to Owler, the company managed to attract $ 413 million in investments after going public.

According to its third quarter 2021 report, The Honest Company has seen its 8th consecutive month of revenue growth, up 6% on Q3 2020 and 47% on 2019. But ROI is still minus and at the moment (November 25, 2021) is -7.96. Will The Honest Company investors manage to increase their money? Time will tell.

# 2. Serena Williams Venture Fund

In 2019, tennis legend Serena Williams ranked among the Forbes 100 Richest Self-Made Women in America. In 2021, her fortune is estimated at $ 240 million. Despite the fact that she is one of the highest paid female athletes in the world, who also makes considerable profit from her participation in advertising, most of Williams’ capital earned from investments.

Serena Williams is not the first athlete to invest her income. But she is one of the few who invest in her own brand. In 2014, Williams secretly founded Serena Ventures. She publicly presented it only on April 17, 2019 on her Instagram.

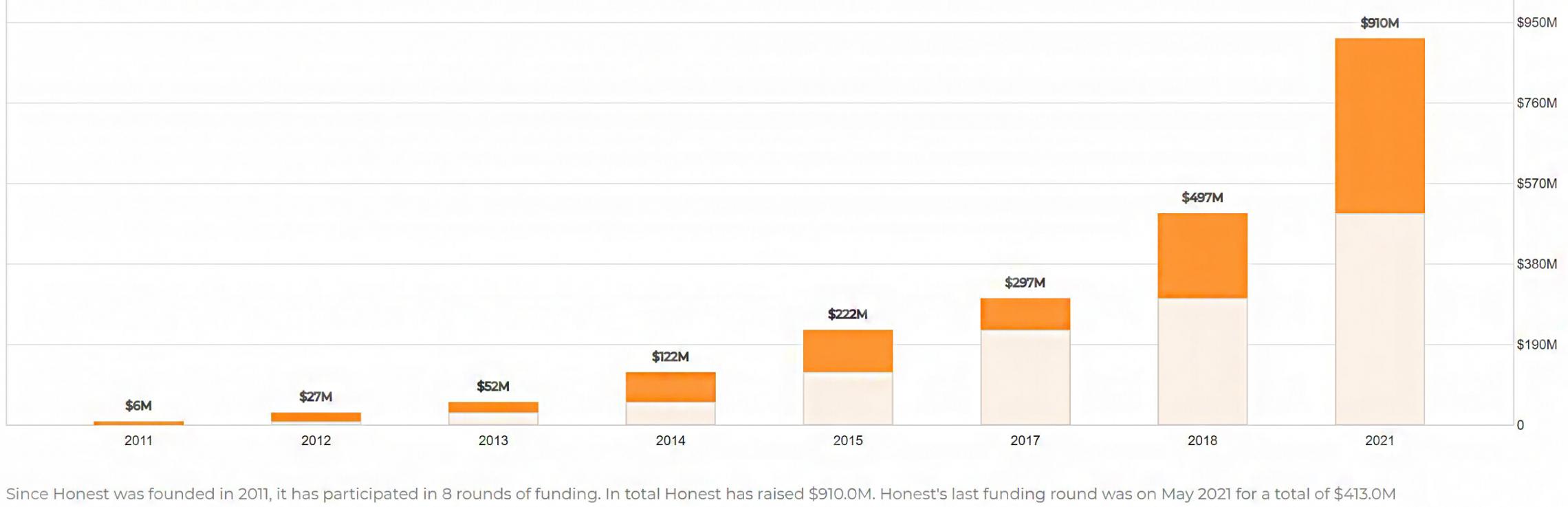

According to Yahoo Finance, among those who were the first to receive financial support from Williams was Andela, an African developer training company. In addition, the investment portfolio includes the San Francisco-based cryptocurrency exchange Coinbase, the Masterclass online learning platform, and the Wave money transfer service, which operates in Africa.

Serena Ventures is interested in young companies that “change the world with their ideas and products”. But at the same time, the tennis player has a stable social position: about 60% of Williams’ investments go to the projects of women founders – in particular, black entrepreneurs.

Serena is convinced that there is an inequality in the distribution of investments in Silicon Valley, and is trying to influence this. In a column for CNN Business, she cites statistics as an example: in 2018-2019, black female founders got only 0.29% of venture capital. “When I invest in startups, I see myself as a black female founder who is often overlooked at first,” says Williams.

An illustrative example of a startup that a tennis player has invested in is the Kiira virtual clinic. It provides women with 24/7 secure and private online medical support from healthcare professionals through the app.

Behind the idea of the company is the personal story of the founder. Black girl Crystal Evuleocha, as a college student, was unable to get medical care at the campus clinic, so she had to look for treatment on the Internet. As a result, Crystal ended up in intensive care. Kiira’s mission is to keep other women, regardless of race or creed, from repeating the sad experience of the founder. By the way, thanks to the startup, Crystal has already been included in the Forbes “30 under 30” list.

According to Worth, at the moment (November 2021) in the portfolio of Serena Ventures there are more than 50 companies with a capitalization of $ 33 billion. Williams confirmed this information on her Twitter. “We’re just getting started ,” she wrote.

# 3. Pharrell Williams’ liquor brand

American rapper Pharrell Williams is known not only for collaborations with Jay-Z and Snoop Dogg. His collaboration with Diageo, which took over the production of the singer’s alcoholic brand, became famous thanks to a lawsuit.

In July 2011, Farrell presented the Qream with Q cream liqueur. The target audience of the product was women. “Alcohol brands use women in their advertisements, but don’t produce anything specifically for them. Therefore, we created Qream with Q. We return the pleasure to the ladies ”, – said the rapper at the official launch.

Farrell was involved in the development of not only the taste, but also the design, and was also involved in the promotion. Diageo, the world leader in the alcoholic beverage industry, was responsible for production and distribution. The drink came in two flavors, Strawberry Crème and Peach Crème, and retailed for $ 29.99.

Sales were not encouraging, and in July 2012 Diageo stopped production of the Qream. Instead of 3 years, as stipulated in the contract, the drink was produced for only a year. Farrell argued that the liquor was not being sold due to incorrect positioning. He insisted that Qream was the “elite leisure drink” and that Diageo served it up as “clubbing.” Moreover, the manufacturer failed to fix the defect in the lid, and also failed to provide sufficient distribution in the target regions. For failure to comply with the terms of the deal, the rapper demanded to pay him $ 5 million in compensation – and the court satisfied his claim.

Not all celebrity alcohol brands fail. For example, actor Channing Tatum has been producing Born and Bred craft vodka, made according to his own recipe, since 2016. And George Clooney in 2018 sold his tequila company Casamigos for $ 1 billion, personally receiving $ 239 million from the deal.

Would you like to receive a digest of articles?

One letter with the best materials per week. Subscribe not to miss anything.

Thanks for your subscription!

# 4. Restaurant business by Robert De Niro

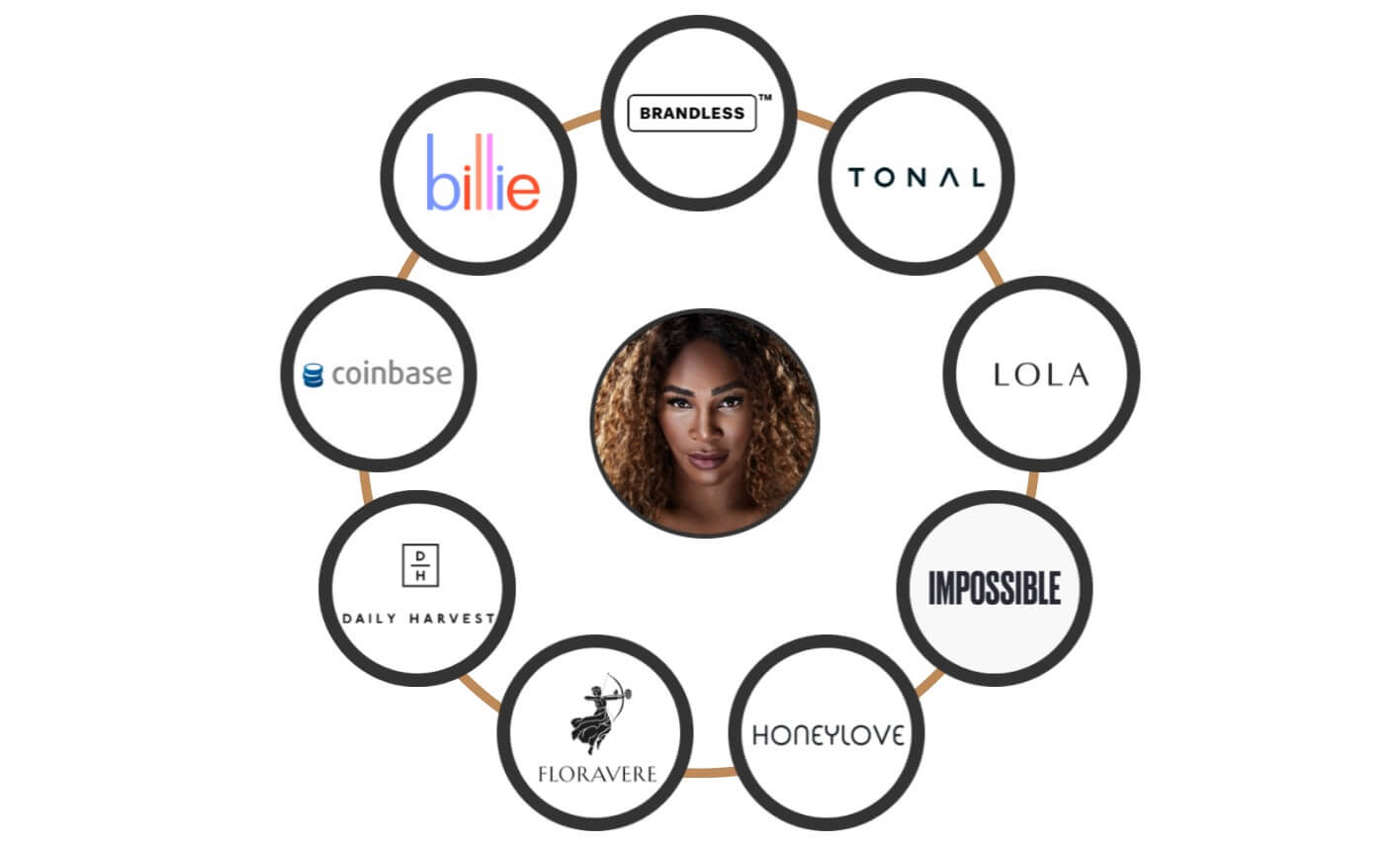

Twin Oscar winner Robert De Niro is the co-founder of Nobu Hospitality, which owns 50 high-end restaurants and 13 hotels worldwide.

In the late 1980s, De Niro was a regular at Matsuhisa, a popular fusion restaurant in Los Angeles with Hollywood stars. In 1989, the actor invited its owner, Nobu Matsuhisa, to open the same restaurant in New York. The Japanese chef visited the city at the invitation of De Niro and even inspected the property that he bought for the establishment, but still refused. Matsuhisa realized that his restaurant in Los Angeles had great potential, but at that time the chef and his staff were not yet ready to open a new outlet.

In 1990, De Niro, together with an experienced restaurateur Drew Niporent, opened the Tribeca Grill, specializing in American cuisine. However, the actor did not abandon the idea of a fusion restaurant – in 1994 he repeated his proposal to Matsuhisa, and he met halfway.

Film producer Neil Teper (as an investor) and Drew Niporent (who took over) also joined the founding of Nobu New York. A year later, in 1995, the establishment received the James Beard Foundation Award, which is called the “Oscar” of the restaurant business, in the category “Best New Restaurant”. And in 1997, the first establishment outside the United States was created – in London.

In 2013, De Niro and partners opened the first 5-star hotel in Las Vegas under the Nobu banner. The idea to develop the brand in this direction belonged to the actor himself: “We have been encouraged to open Nobu restaurants in a variety of locations, hotels and shopping malls. If there is a demand for this, why don’t we become a hotel ourselves? ”

Of the 13 hotels owned by Nobu Hospitality, 6 are located in Europe. The hotel concept combines minimalist Japanese tradition with modern luxury, yet each is unique.

In 2018, the company announced that another area of its activity will be condominiums – housing complexes in joint ownership. The first such apartments in Toronto were sold out within 3 months after the project was announced. Nobu was expected to reach $ 1 billion in revenue by 2023. However, in 2020, the hotel and restaurant business was hit by the Covid-19 pandemic. In July 2020, it became known that the Nobu chain of elite restaurants received 14 loans from the state for up to $ 28 million, after which public criticism fell on the government program, because financial support was to be provided to small businesses.

In the near future, Nobu plans to open three new locations during 2022-2023, together with Caesars Entertainment, which deals with casinos and luxury hotels.

# 5. Shaquille O’Neill’s business empire

According to Vault, 60% of former NBA players go bankrupt within 5 years of retirement. Shaquille O’Neal was not included in these statistics, because his talents were never limited to basketball. The NBA star invested his earnings before retiring in 2011. For example, he invested in Google and Apple before these companies went public. According to the Daily Mail, O’Neill’s fortune is estimated at $ 400 million today.

In an interview with The Wall Street Journal, Shaquille admitted that his investment strategy was influenced by Jeff Bezos, who invests his money in businesses that can change human lives. “When I adopted this strategy, my fortune quadrupled.”, – said the former basketball player.

O’Neill invested not only in technology, but also in nutrition. He owned 155 Five Guys restaurants, representing 10% of the company’s entire franchise portfolio. In 2016, the basketball player sold his stake. It was “good business”, he said. In 2019, O’Neill joined the board of directors of Papa John’s and invested $ 2.8 million in 9 locations in Atlanta, Georgia. Moreover, Shaquille became the brand ambassador and pledged to promote it on his pages in social networks. The total cost of the three-year contract with the basketball star is estimated at $ 8.5 million.

The deal was preceded by a scandal with founder and former CEO John Schnatter, who indulged in racist insults during a conference call. This was followed by a notable drop in sales in North America, and O’Neill’s involvement in the marketing campaign was expected to remedy the situation. And so it happened: the news about the joining of the athlete to Papa John’s provoked an increase in the company’s shares by 5%.

O’Neill’s other investments include 150 car washes, 40 gyms, 17 pretzel stores, a donut shop, a movie theater, a burger and Shaquille’s restaurant with the player’s name on the sign.

0

0

O’Neill has produced Shaq Soda and Shaq Fu Punch soft drinks, Shaq clothing and jewelry line, and sneakers, which are associated with a separate story.

The fact is that O’Neill has always worked with Reebok. But in 2016, he tore off a $ 40 million 5-year contract to make affordable shoes under his own brand. The Shaq sneakers cost about $ 19-20 per pair and were sold at Walmart. Since then, over 400 million pairs of Shaq shoes have been sold.

As the basketball player later admitted, he was pushed to this decision by a conversation with an ordinary woman – she harshly criticized the price of sneakers that Shaquille advertised. The Reebok Shaq Attaq cost $ 67.99 at the time.

But the story with Reebok did not end there. In August 2021, it became known that Authentic Brands Group (ABG) is buying the Reebok brand from Adidas for 2.5 billion. The deal will be closed in the first quarter of 2022. O’Neill, as a shareholder of ABG, fulfilled his long-held dream of becoming the owner of Reebok. In collaboration with the basketball player, the brand is expected to offer updated lines in a retro style for a new generation of consumers.

All business content in a convenient format. Interviews, cases, life hacks bldg. the world – in our telegram channel. Join!

# 6. Vegan Shoes Natalie Portman

In January 2008, the actress launched a line of vegan shoes. Vegetarian Portman opposes items made from animal materials. Creation of her own products was a demonstration of the personal views of the actress on the ethics of fashion. It was announced that 5% of the sales will go to charity.

The limited edition was sold at the Té Casan store in New York. However, in November 2008 the company put up all of its shares for sale, and by the end of the month the boutique was closed. The company likely ceased operations due tothe 2008 economic crisis, when retail sales fell to a 35-year low. However, the failure of the line itself can be explained by the price tag: the average cost of $ 200 per pair seemed overpriced to the followers of ethical fashion.

If Natalie Portman decided to launch her products these days, most likely she would be successful. According to Allied Market Research, in 2020 the global market for vegan footwear was $ 157.9 billion, and by 2030 this figure will exceed $ 300 billion. Large shoe brands are also concerned about the ethical use of animal skins. For example, in 2018, Adidas launched a vegan version of the classic Stan Smith sneakers. Many stars have produced their own animal-free footwear lines, including Miley Cyrus, Jason Momoa and Catherine Zeta-Jones.

It looks like Natalie Portman’s idea of launching vegan shoes in 2008 was simply out of place.2

Would you like to receive a digest of articles?

One letter with the best materials per week. Subscribe not to miss anything.

Thank you for subscribing!