This is one of the top questions asked by newcomers to investing with this article

I want to close all the doubts that gnaw at those who have embarked on the path of private investing and for some reason think that age is a hindrance.

First, I will immediately remove all doubts – you can invest at any age. Yes, many financial advisors will tell you that it is better to start at 20. But tell me then, please, what were the opportunities for investing 10-20-30 years ago? I think everyone has the answer. Yes, it’s better to start earlier, the sooner, the better, for example, at the age of 18-20, but first of all, who at this age thinks about investing seriously? Units. Secondly, and what if you are not 18-20 years old, that’s all, we disperse and we won’t invest any more, let’s give way to the young? It sounds at least irrational.

So, with the fact that you can start investing at any age, we figured it out. Let you 30-40-50-60 +, you can invest. There are nuances that we will talk about below, but the best time to start investing is Today and Now. You, dear readers, are reading this article now, which means that, although a small, micro-step, you still made a step towards investments, with which I congratulate you.

So, how should your investment strategy depend on how far you are from the future well-deserved rest, which we call a pension.

You understand that you will not always or want to work actively, based on this and build your plans. In general, the period of your active making money, when you want to work and make money as an investment, is your maximum period of active investment.

Yes, some people have it small. But it is better to have at least some money than not to have it at all. I have two examples of very mature investors, both women, who started investing very close to their well-deserved rest. And they got a success. And these are public examples. And how many of these non-public, I tell you for sure, there are many of them.

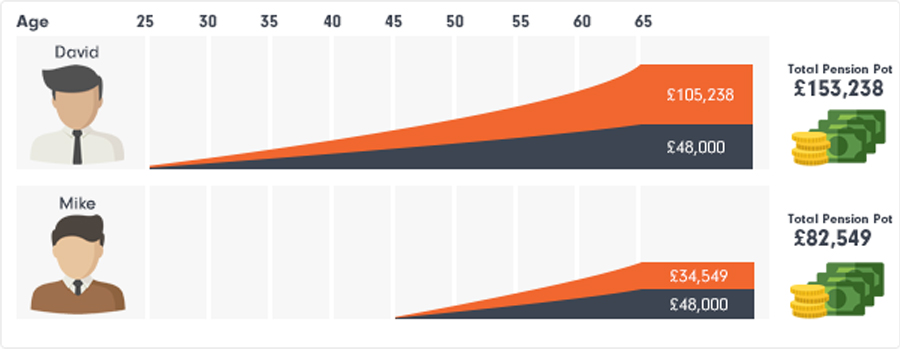

What else you need to pay attention to is the risks. Yes, there is the concept of an individual risk profile, which we discussed in our pilot course on investments, we consider there a complex risk profile, but in general you should be guided as follows. If you are 20 years old, then you have the opportunity to take risks. There is a lot of time to acquire more risky instruments, test them, incur losses. If you’re 30 or over, you should be less risky. Investing in a high-risk instrument, and even for the entire deposit, is already at least a reckless business. And the further you go, the less risky instruments you can choose.

Of course, not everything is so simple, your risk profile depends not only on your age, but also on goals and many other factors, but here we are analyzing exactly the age.

Once again, you can start investing at any age and start earning income!

It’s better to have capital that you started to create at 50 than not to have any capital. Now, here are two inspiring examples of women investors.

So, the first story. Frau Motz. She came to the stock exchange when she was … 75 years old. For 10 years, without an economic education, special programs and the Internet, she made a fortune of 3 million euros, having only income – a small pension and a small inheritance from her husband in the form of shares. These shares rose in price and Ingeborg Motz decided that this was a sign. She began trading over the phone, reading stock information from newspapers. She developed her own buying algorithm, which helped her out for many years – she followed the Frankfurt stock exchange index, bought stocks with high dividends, purchased shares of companies founded more than 100 years ago. She no longer actively invests – her fortune works for her.

The second story is from Russia. Larisa Morozova started investing at the age of 53 and has also achieved success. She started with 10 thousand rubles of investments, and now her capital also works for her. She also focuses on dividend stocks and selects them very carefully.

Hope you were inspired by these success stories. As you can see, these women started out small, at a fairly mature age, but achieved outstanding results.